All Categories

Featured

In 2020, an estimated 13.6 million U.S. houses are recognized investors. These houses control enormous riches, approximated at over $73 trillion, which stands for over 76% of all private wealth in the U.S. These capitalists take part in financial investment possibilities normally inaccessible to non-accredited financiers, such as investments secretive business and offerings by specific hedge funds, private equity funds, and endeavor resources funds, which enable them to expand their wide range.

Check out on for information regarding the latest accredited investor alterations. Banks normally money the majority, yet hardly ever all, of the funding needed of any type of procurement.

There are largely 2 regulations that allow providers of safety and securities to use endless quantities of safeties to capitalists. high returns investments for accredited investors. One of them is Guideline 506(b) of Guideline D, which allows a company to market safeties to endless accredited financiers and up to 35 Innovative Financiers just if the offering is NOT made via basic solicitation and basic advertising

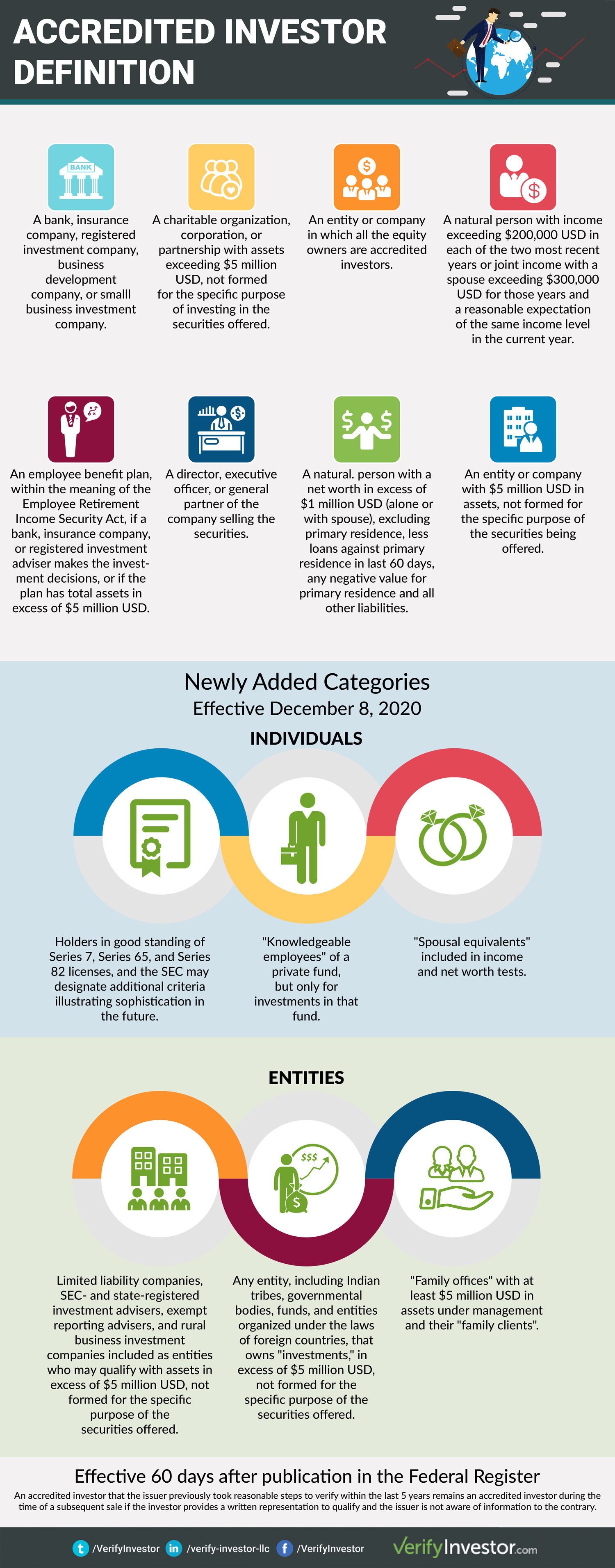

The newly embraced modifications for the initial time accredit individual investors based on monetary sophistication needs. The amendments to the recognized capitalist interpretation in Regulation 501(a): consist of as accredited capitalists any type of count on, with total possessions much more than $5 million, not formed especially to acquire the subject safeties, whose purchase is directed by a sophisticated person, or consist of as accredited financiers any entity in which all the equity owners are approved investors.

Under the federal safety and securities legislations, a business might not use or offer securities to investors without registration with the SEC. There are a number of enrollment exemptions that ultimately increase the world of potential investors. Numerous exceptions require that the investment offering be made just to persons that are recognized investors.

Furthermore, certified investors typically receive more favorable terms and greater possible returns than what is offered to the public. This is because private positionings and hedge funds are not required to adhere to the exact same regulative requirements as public offerings, enabling even more flexibility in regards to investment strategies and prospective returns.

Authorized Investor

One factor these protection offerings are limited to certified capitalists is to ensure that all getting involved financiers are financially sophisticated and able to fend for themselves or sustain the threat of loss, thus providing unneeded the protections that come from an authorized offering.

The web worth test is fairly basic. Either you have a million bucks, or you do not. On the earnings test, the person needs to satisfy the limits for the three years regularly either alone or with a partner, and can not, for instance, satisfy one year based on specific income and the next two years based on joint revenue with a partner.

Latest Posts

How Tax Lien Investing Works

Tax Liens Investing Reddit

Where To Find Tax Lien Properties